About JAC website multilingualization

The JAC website uses AI automatic translation (machine translation). Because it is machine translation, the translation may not always be accurate.

About the automatic translation (machine translation) function

- The website is automatically translated (machine translated) according to the language settings of the device you are using to view the website.

- To change the language, open the language selection panel from the Language button in the header and select the language.

- Some proper nouns may not be translated correctly.

- Some pages are not automatically translated. PDFs are not translated.

- Links to external sites will not be translated.

Note

- Please enable JavaScript when using this function.

- This function may not be available in some browsers or viewing environments.

- やさしい日本語

- ひらがなをつける

- Language

We provide multilingual content through machine translation. Translation accuracy is not 100%. About the multilingualization of the JAC website

Need help?

- Home

- Chapter 3 01. Preparing for Specified Skilled Worker Acceptance Plan in the construction field Application

- 06. Document No. 3 Document clarifying the number of full-time employees

Chapter 301. Preparation for Specified Skilled Worker Acceptance Plan in the construction field Application

06. Document No.3 Document revealing the number of full-time employees

【overview】

These are the documents required for online application.

システム項目:16

![[Note] Submit the most recent notification](/howto/uploads/3-01-06_step01.jpg)

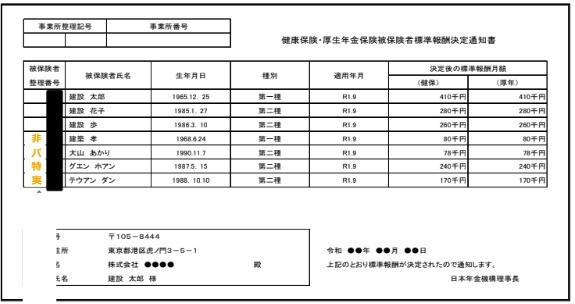

■ Corporations or individual business owners with 5 or more employees (health insurance and employee pension insurance applicable business)

Please submit a copy of the "Notice of Standard Remuneration Determination for Health Insurance and Employees' Pension Insurance Insured Person" and, for those employed close to the application date, a copy of the "Notice of Confirmation of Health Insurance and Employees' Pension Insurance Insured Person Qualification Acquisition and Standard Remuneration Determination."

■ If you are a sole proprietor with four or fewer full-time employees

Please submit a copy of your "Employment Insurance Insured Person Register."

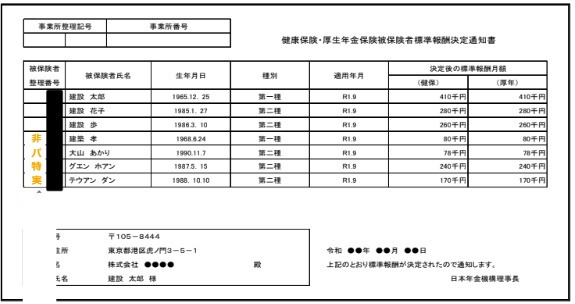

![[Caution] Masking the insured person's serial number](/howto/uploads/3-01-06_step02.jpg)

Do not mask any other areas.

Masking other than specified areas on the Standard Remuneration Determination Notice and Employment Insurance Insured Person Register is not permitted.

Confirming the number of full-time employees is a very important point in the review process, so we appreciate your cooperation.

・ Non-executive directors: "Non" to the left of their names

・Full-time employee: No need to enter

・ Specified Skills Designated Activities scheduled to migrate, etc.: "Special" to the left of the name

・Part-time workers with other status of residence: "Pa" next to their name

・Part-time officers with other status of residence: "Non" next to their name

・Full-time employees with other status of residence: Write the status of residence (" Gijinkoku", "permanent resident", "permanent residence", etc.) next to your name.

*All foreigners must state their status of residence.

![[Counting the number of full-time employees] <Corporations>](/howto/uploads/3-01-06_step05.jpg)

This applies to those who are enrolled in social insurance (including National Health Insurance for Construction Workers).

[Classification: Conditions]

・Officers: Full-time officers with a certain amount of compensation or more.

・Japan employees: Those who are not part-time workers such as part-time workers

・Foreign employees: Those who are not part-time workers such as part-time workers and whose status of residence is not "Specified Skills", "Technical Intern Training", or "Designated Activities (Specified Skills scheduled to be transferred, etc.)"

![[Counting the number of full-time employees] <Corporations>](/howto/uploads/3-01-06_step06.jpg)

〈Employees〉

In principle, "full-time" in Specified Skilled Worker System means that the number of working days is 5 days or more per week and 217 days or more per year, and the weekly working hours are 30 hours or more.

Employees who work at only one business office and meet the above definition of full-time are counted as "full-time employees".

This standard is indicated on page 42 of the Immigration Agency's "Operational Guidelines for Specified Skilled Worker Acceptance", and the Ministry of Land, Infrastructure, Transport and Tourism has adopted a similar interpretation.

*If a Japan person is employed for a fixed term, it can be counted if the above conditions are met and the remuneration of the Japan person for the fixed-term employment is above the minimum wage.

<board member>

Being registered as an officer alone does not count as a full-time employee.

Unlike employees, directors are not obligated to work the hours set by the general company. Therefore, they cannot be defined as "full-time" like employees, so whether they can be counted as full-time is determined based on whether the standard monthly remuneration stated in the "Notice of Standard Remuneration for Health Insurance and Employees' Pension Insurance Insured Person" is an amount that can be considered as working full-time.

![[How to count the number of full-time employees] <Sole proprietorship> If there are five or more full-time employees](/howto/uploads/3-01-06_step07.jpg)

All employees, except for business owners, are required to enroll in social insurance (including National Health Insurance for Construction Workers).

[Category: Condition]

・Employer: Always count

・Japanese employees, foreign employees: same as for corporations

![[How to count the number of full-time employees] <Sole proprietorship> If there are four or fewer full-time employees](/howto/uploads/3-01-06_step08.jpg)

Everyone except the business owner and full-time employees is required to enroll in employment insurance.

Please attach the employment insurance insured person register.

[Category: Condition]

・Employer: Always count

・Japanese employee: A person who is not a part-time worker or other short-term worker, and has a certain amount of wages listed in the salary/wage breakdown of the income and expenditure statement of the tax return.

![[How to count the number of full-time employees] <Sole proprietorship> If there are four or fewer full-time employees](/howto/uploads/3-01-06_step09.jpg)

[Classification: Conditions]

・Foreign employees: Those who are not part-time workers such as part-time workers, but who have a certain wage stated in the salary and wage breakdown on the income and expenditure statement of the tax return, and whose status of residence is not "Specified Skills", "Technical Intern Training", or "Designated Activities (Specified Skills scheduled to be transferred, etc.)"

・Full-time employees: Those who have a certain amount or more of salary in the breakdown of full-time employees' salaries in the financial statements.

[In the case of a single parent]

A sole proprietor is always counted as one person.

Please attach the following documents to confirm full-time employment:

A copy of your tax return (with the tax office's acceptance stamp, or a printout of the acceptance screen if you filed electronically)

The total number of Specified Skilled Worker (i) must not exceed the total number of full-time employees (excluding Specified Skilled Worker (i), Technical Intern Training students, and Designated Activities (e.g., Specified Skills migration) of the person who intends to become a Specified Skills affiliate (host company).

Construction technicians are expected to work not only at one place of business, but at various work sites. A certain number of full-time employees is necessary so that supervisors can properly guide and train Type 1 specified foreign nationals who require support, so the total number is set.

- 0120-220353Weekdays: 9:00-17:30 Saturdays, Sundays, and holidays: Closed

- If you are considering joining

Companies - Contact Us